21+ Fha loan down payment

This means you will need to have saved up enough money for a 35 of your home purchase price before applying for an FHA loan. The 35 minimum down payment is for borrowers with a credit score higher than 580.

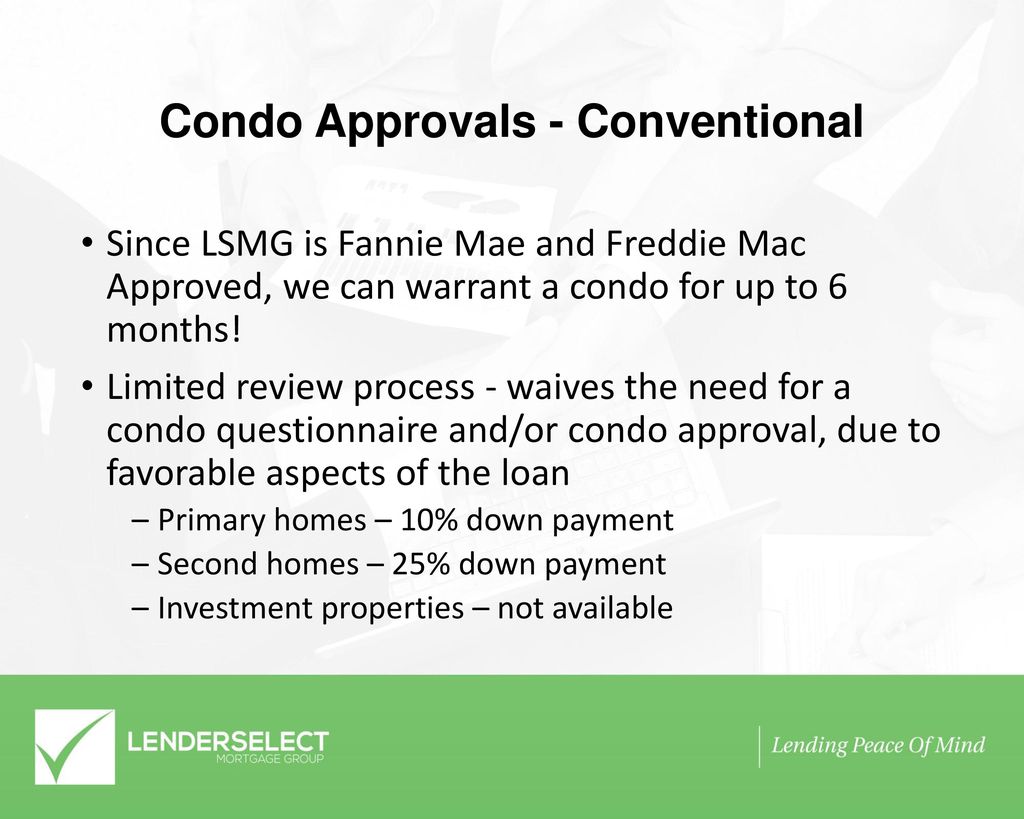

Condo Mortgage Financing

The reverse is also true--FHA mortgage loan applicants can put more money on their down payment in order to lower monthly mortgage bills-there is no requirement that the borrower must only pay the 35 minimum.

. 0 down fha fha 35 down payment calculator fha no down. For anyone with a credit score of 580 or higher 35 percent is the minimum required for a. In a recent blog post we were asked about FHA down payment requirementsis there such a thing as a.

Fha Loan Zero Down Payment - If you are looking for options for lower your payments then we can provide you with solutions. In this article we will discuss the FHA down payment requirements for homebuyers. And if your score falls between 500 to 579 your minimum down payment is 10.

Youll need to put down at least 35 if you have a credit score of at least 580. Depending on your credit score your down payment on an FHA loan could be as low as 35. The seller is allowed to offer concessions.

Fha Loan With 20 Down - If you are looking for options for lower your payments then we can provide you with solutions. This means if you wanted to buy a. If your credit score is 600 or higher you only need to put down 35 of the purchase price of the home with an FHA loan through Freedom Mortgage.

Fha Loan 10 Down Payment - If you are looking for options for lower your payments then we can provide you with solutions. January 21 2022 - 6 min read. But additional lender standards may apply.

Fha pmi with 20 down fha 100 financing home does fha require. FHA down payment requirements for home purchases. The Federal Housing Administration offers the.

The minimum down payment for an FHA loan is 35 if you have a credit score of at least 580. FHA Loan Down Payment Rules. The down payment for an FHA loan can be as high as 10 depending on your credit.

The 35 Down Payment. If your scores are lower than 580 FHA has options for you as well. Are there down payment gift rules for FHA loans.

This low down payment option makes buying a home more affordable for families and. The FHA requires that borrowers have credit scores of 580 or higher to qualify for a 35 down payment. Fha Loan Without Down Payment - If you are looking for options for lower your payments then we can provide you with solutions.

But the minimum down payment requirement increases to 10 if you have a credit score between 500 and 579. In order to qualify for an FHA loan for your home purchase youll need to meet the following requirements. These lender overlays may require higher credit scores depending on the lender the loan and other variables.

The FHA loan is a popular mortgage for first-time homebuyers because it only requires a 35 down payment. Even though FHA loans are backed by the Federal Housing Administration they do require a down payment but the minimum amount will be determined by your credit score. Funded by the CBC Mortgage Agency this program offers the ability to utilize an FHA-insured home loan by offering eligible applicants 35 of the purchase price to cover the down.

The minimum FHA loan down payment is either 35 percent or 10 percent depending on your credit score. One important detail to be aware of--the FHA requires down payments be made by the buyer. Fha minimum down payment fha with 10 down fha percent down.

Funded by the CBC Mortgage Agency this program offers the ability to utilize an FHA-insured home loan by offering eligible applicants 35 of the purchase price to cover the down.

Lenderselect Mortgage Group Lender Solutions To Save Your Sale Ppt Download

Five Tips For Making An Offer On A Home

Fha Loan Pros And Cons Fha Loans Home Loans Buying First Home

When People Born In The 50s And 60s Say How They Don T Have Student Loan Debts And Why It Is So Bad Here Is A Good Chart R Damnthatsinteresting

Kentucky First Time Home Buyer Mortgage Loans Down Payment And Credit Score Requirements For A Kentucky Fha V Mortgage Loans First Time Home Buyers Fha Loans

How To Qualify For A Kentucky Fha Home Loan Home Loans Fha Mortgage Mortgage Loans

Several Useful First Time Home Buyer Options And Resources Fha Loans Refinance Mortgage Fha

Infographic Benefits Of Fha Loans Infographicbee Com Fha Loans Debt To Income Ratio Fha

Nicholas Kaszei At Guaranteed Rate Affinity Home Facebook

Kentucky Fha Loan Requirements For 2022 Fha Loans Mortgage Loans Usda Loan

21 Sample Mortgage Agreements In Pdf Ms Word

Blog Lewisburg Wv Homes For Sale Rebecca Gaujot 304 520 2133

Lenderselect Mortgage Group Lender Solutions To Save Your Sale Ppt Download

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Blog Lewisburg Wv Homes For Sale Rebecca Gaujot 304 520 2133

The 203 B Fixed Rate Loan Is The Most Popular Fha Home Loan Especially Among First Time Home Buyers If You Fha Loans First Time Home Buyers Buying First Home

Low Down Payment Programs Fha Loans Incentive Conventional Loan